On Wednesday (March 6), Bitcoin suddenly crashed nearly 8% from its historical high of $69,000, and the currency price fell back to the $63,000 level to take a breather. According to on-chain analyst data, the plunge is suspected to be related to an old miner address with a history of more than 10 years transferring 1,000 Bitcoins to the Coinbase exchange.

Bitcoin's rapid rise over the last month, which hit an all-time high on Tuesday, quickly reversed course, meaning some early miners have begun selling their old block rewards, putting pressure on Bitcoin's price.

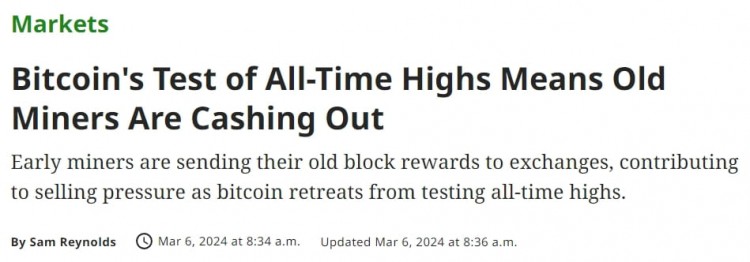

CryptoQuant found on-chain data showing that just before Bitcoin hit a new high of around $69,000 before plummeting to $62,000 on Tuesday, 1,000 Bitcoins worth about $69 million were transferred to the Coinbase exchange from an address dating back more than a decade. The research firm said it was related to miners.

According to CoinDesk, the transfer of the long-dormant token to the large cryptocurrency exchange Coinbase may be a prelude to the sale.

CryptoQuant analyst Bradley Park noted in a report: “Considering that trading order books show liquidity of 5-10 Bitcoins for every $100 change in price, selling 1,000 Bitcoins is likely to trigger a significant price drop, especially As traders wait to short Bitcoin’s all-time highs like they did on Tuesday.”

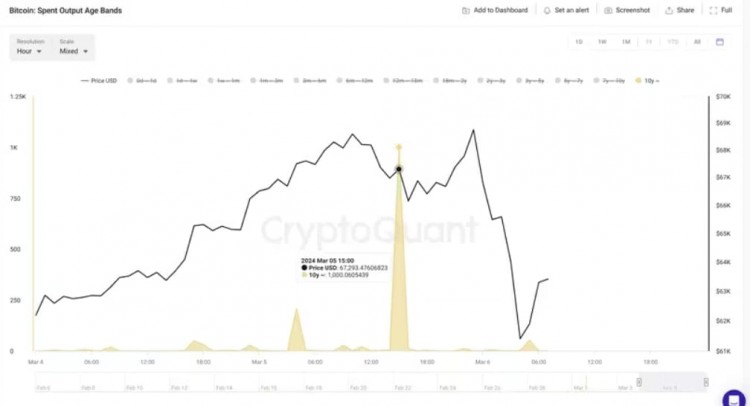

Park said that the recent influx of Bitcoin into exchanges reminded him of the sharp increase in Bitcoin inflows that occurred before the 40% price drop on March 12, 2020, when the severity of the COVID-19 epidemic began to rapidly escalate, causing governments around the world to A lockdown began, forcing traders to flee to safety.

When the sell-off finally ended, Bitcoin had bottomed at $38,500.

"That time, it was miners, too," Park continued.

In fact, in terms of news, the U.S. Bitcoin Spot ETF provides positive signals.

Data posted on Twitter by Bloomberg analyst Eric Balchunas showed that the single-day trading volume of 10 Bitcoin spot ETFs reached $10 billion on Tuesday, a record high, breaking the historical record set last Wednesday.

Among them, BlackRock IBIT is $3.703 billion, Fidelity FBTC is $2.028 billion, Bitwise BITB is $294 million, and ARK 21Shares ARKB is $484 million. These funds all hit new highs.

However, the strong sentiment of "buying on the news and selling on the news" led to this flash crash.

CoinGlass data shows that in the past 24 hours, the entire cryptocurrency market liquidated $1.16 billion in positions, and a total of 313,600 people liquidated their positions. Among them, long orders were liquidated to US$881 million, and short orders were liquidated to US$274 million. By currency, the liquidation of Bitcoin was approximately US$322 million, and that of Ethereum was approximately US$207 million.