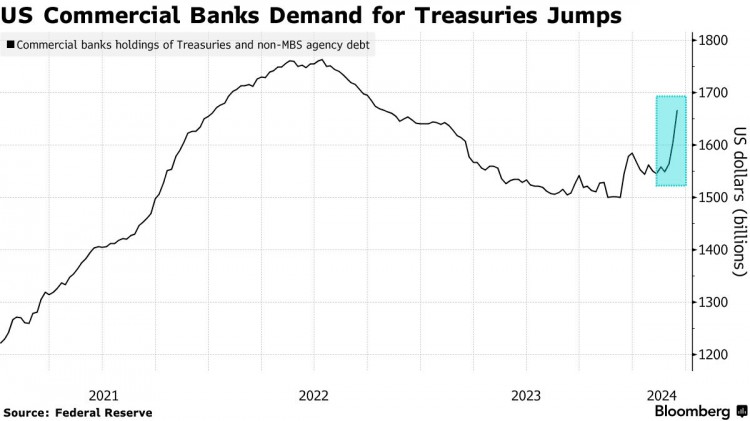

美國銀行正以2020年疫情引發市場擔憂高峰以來最快的速度搶購美國國債。加拿大皇家銀行資本市場策略師警告稱,瘋狂的購買步伐可能會放緩。

根據聯準會編制的每週持有數據,截至 3 月 13 日的兩週內,商業銀行從聯邦機構購買了 1,030 億美元的國債和非抵押債券。分析師通常使用這個類別來衡量對美國國債的需求。加拿大皇家銀行的數據顯示,這是自 2020 年 6 月以來最大的兩週百分比增幅。

美國商業銀行對美債的需求激增

加拿大皇家銀行資本市場美國利率策略主管 Blake Gwinn 在報告中表示:

“由於存款餘額仍然很高,貸款增長放緩,美聯儲降息週期迫在眉睫,銀行開始在其投資組合中添加高收益國債是有意義的。”

然而,考慮到兩週波動的幅度,加拿大皇家銀行分析師認為,“可能還有一些更多的機械因素影響這一數據。至於具體是什麼,我們並不完全確定。”

聯準會主席鮑威爾上週在為期兩天的聯邦公開市場委員會會議結束時發出的信息是,如果價格壓力繼續緩解,今年某個時候降息將是適當的。 Gwinn補充說,銀行購買美國國債的激增並未引發市場反應,這似乎表明銀行可能正在購買短期國債。他確實預期銀行對國債的需求將在中長期普遍持續。

數據顯示,美國最大的金融機構主要購買債券。本週早些時候,道明證券策略師將近期銀行需求與聯準會支持放緩資產負債表縮減的言論聯繫起來。達拉斯聯邦儲備銀行主席洛根一月初表示,政策制定者應開始考慮何時以及如何透過再投資更多資金來縮減 QT 計畫。聯準會理事沃勒在3月1日的演講中談到了這個話題,表示支持增加短期國債在聯準會資產中的比例。

然而,加拿大皇家銀行的格溫寫道:“當銀行確實開始增持美國國債時,更有可能是在長期持續的時間內零碎增持,而不是在兩週內大規模購買。”

太平洋投資管理公司(PIMCO)正在減少對美國國債的投資。其首席投資官安德魯·鮑爾斯(Andrew Balls)向英國《金融時報》表示,這家巨型債券基金持有的美國國債比平常少,更喜歡英國和加拿大等國的債券,因為他擔心通膨重燃將迫使聯準會降息幅度遠小於以往。比最新的「點圖」顯示的要多。

"Outside of the U.S., we're seeing more evidence that inflation is correcting," Bowles said. "I think you can see the balance of risks from the Fed cutting interest rates more slowly than the market expects, but outside of the U.S. some central banks may move more than the market expects."

Although long-term inflation expectations in the United States are lower, inflation in the United States remains significantly higher relative to the sharp fall in inflation from the 2023 peak in the United Kingdom and Europe.

The view from the firm, which has $1.9 trillion in assets under management, is similar to consensus expectations for a Fed rate cut, but Bowles worries about the risk of "increased economic activity and sustained inflation" in the U.S., adding "you'll see to an ongoing theme of American exceptionalism.”

Expectations for interest rate cuts from the Federal Reserve, the Bank of England and the European Central Bank have fallen sharply in the past three months, with the ECB expected to cut interest rates four times in 2024, while the Bank of England and the Federal Reserve are expected to cut interest rates three times.

Finally, Barrs worries about a repeat of the surge in yields seen last fall, when markets fretted that government borrowing plans were larger than expected. "You can imagine this happening again," Powers said. "Neither Democrats nor Republicans seem concerned about the level of the fiscal deficit... If nothing exciting happens (like a UK debt crisis in 2022), the term premium is likely to slowly rise."

The chief investment officer of PIMCO said he prefers to invest in bonds that are more sensitive to interest rate changes in the United Kingdom, Australia, New Zealand and Canada. In December last year, the Financial Times reported that Pimco's chief investment officer believed that the UK was at risk of a severe economic recession and that he was betting larger than usual on British government bonds. This is not a good backdrop for the United States, which is seeing increasing bond auctions.

Article forwarded from: Golden Ten Data