Every technological revolution in history tells us that the key to success lies not only in early exposure to technology and practice, but also in a deep understanding of the nature of technology, an accurate grasp of market trends, and a keen insight into future development. This cognitive perspective beyond the conventional is a key factor in enjoying the dividends of Web3.0. In 2024, the change in thinking is particularly important. We conducted in-depth analysis and forecasts of industry trends this year and proposed six key trends. Our purpose is to provide everyone with a new perspective and help those who are concerned about Web3.0 seize the opportunities of the times and achieve sustained growth and development. These trends cover all aspects from technological innovation to regulatory frameworks, from market dynamics to user participation, providing us with anticipatory and response strategies for upcoming industry changes. This article will continue to share the six core trends of the "2024 Web3.0 Digital Asset Trend Report".

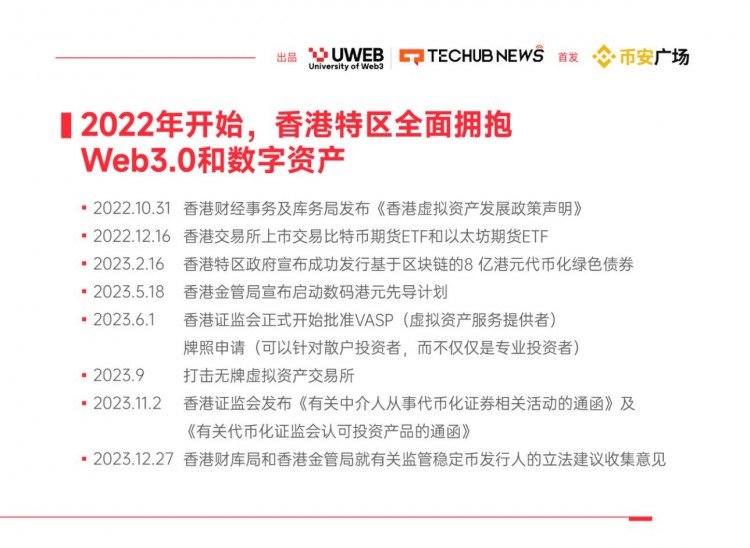

Since 2022, the Hong Kong SAR has taken a series of initiatives to demonstrate its active layout and leadership on the global digital economic stage. The "Hong Kong Virtual Asset Development Policy Statement" issued by the Financial Services and the Treasury Bureau of Hong Kong is an important policy milestone and a declaration of Hong Kong's move towards the future of digital assets and Web3.0.

The Hong Kong SAR government has taken a number of specific measures to promote digital assets. For example, by issuing blockchain-based tokenized green bonds, Hong Kong SAR has demonstrated its capabilities in leveraging blockchain technology for innovative financial instruments. In addition, the success of the Bitcoin and Ethereum ETFs launched by the Hong Kong Exchange not only provides investors with more diversified investment options, but also sets a new benchmark for the Hong Kong SAR in the field of global digital asset trading. Hong Kong’s active promotion of research on digital Hong Kong dollars also reflects its forward-looking thinking in exploring central bank digital currency (CBDC). In terms of supervision, Hong Kong has broadened the scope of participants in the digital asset market and improved the transparency and security of the market by issuing virtual asset trading and asset management licenses to institutions that can serve retail investors. In December, Hong Kong announced that it was ready to begin accepting applications for digital asset spot ETFs and supervision of stablecoin issuance, which gave a boost to the development of Web 3.0 in Hong Kong.

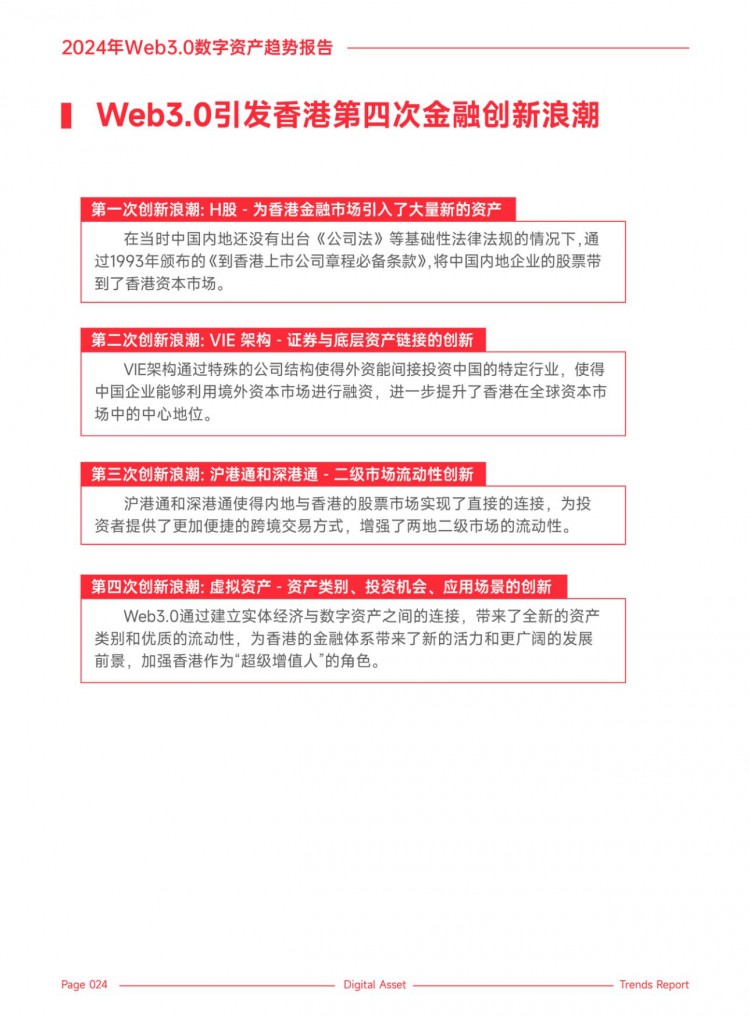

Innovation is the basis for change and development, and every important innovation in Hong Kong's financial market has consolidated and strengthened its position as an international financial center. We can regard the introduction of H shares, the creation of VIE structures and interconnection with the mainland market as the first three waves of innovation in Hong Kong's capital market. The first wave of innovation in the Hong Kong capital market was the introduction of H-shares, which brought the stocks of mainland Chinese companies to the Hong Kong capital market. The listing of H shares was essentially carried out through the "Required Articles of Association of Companies Listed in Hong Kong" promulgated in 1993 when mainland China had not yet promulgated basic laws and regulations such as the "Company Law". The emergence of H-shares has fundamentally changed the interaction between mainland companies and international capital markets, promoted the flow of capital, and introduced a large number of new asset classes to Hong Kong's financial market.

The second wave of innovation is the creation of the VIE structure. The VIE structure allows foreign capital to indirectly invest in specific industries in China through a special corporate structure. It is an innovation in linking securities and underlying assets, allowing Chinese companies to utilize global capital and resources to achieve rapid development. , further enhancing Hong Kong’s status as a global financial center. The third wave of innovation is the trading interconnection mechanism between the mainland and Hong Kong stock markets, that is, the implementation of Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect, which has achieved a direct connection between the stock markets of the mainland and Hong Kong and provided investors with a more convenient cross-border trading methods and enhance the liquidity of the secondary markets in both places.

Web3.0, which is being gradually realized, may be the fourth wave of innovation in Hong Kong's capital market. In particular, RWA tokenization not only brings new asset classes and high-quality liquidity by establishing a connection between physical assets and the digital economy. It can also bring new vitality and broader development prospects to Hong Kong’s financial system, strengthening Hong Kong’s role as a “super value-added person”.

The key to the development of Hong Kong's Web3.0 lies in the construction of its financial infrastructure. It is expected that Hong Kong will have four major international clearing and settlement systems operating in parallel in the future, including a settlement system based on offshore RMB and CIPS, an international settlement system based on US dollars and SWIFT, a real-time payment settlement system (RTGS system) based on Hong Kong dollars, and a digital asset-based settlement system. and a new settlement system based on blockchain. The parallel operation of these four systems will be the key to building "International Financial Center 2.0". To this end, it is necessary to improve their respective regulatory systems, business institutions, asset and talent reserves, and technology accumulation.

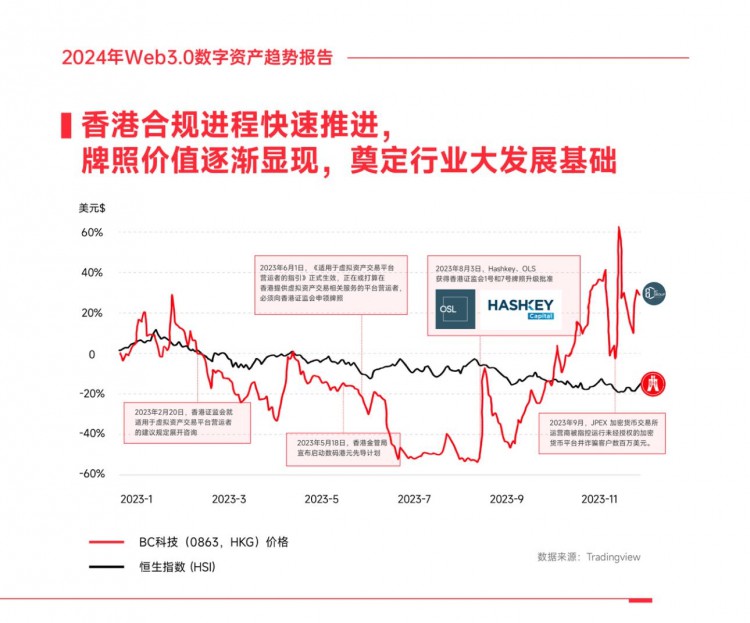

Hong Kong has also achieved remarkable results in the rapid advancement of the compliance process, and the value of licenses has gradually emerged, laying the foundation for the great development of the industry. Comparing the stock price of OLS (formerly BC Technology) with the Hang Seng Index (HSI), we can observe that OLS's stock price clearly outperformed the market in the second half of the year. Especially on August 3, after Hashkey and OLS announced that they had obtained the upgrade approval of No. 1 and No. 7 licenses from the Hong Kong Securities Regulatory Commission, OLS's stock price fluctuated violently in the short term. The subsequent rise in the stock price may indicate that the market has invested in this strategic investment. positive response, believing it will have a positive long-term impact on the company. This performance is likely to reflect mainstream institutional investors' recognition of the growth potential and long-term value of the Web 3.0 field. At the same time, it reflects that Web3.0 as an industry is gradually gaining widespread attention and trust from the mainstream investment market. Investors and analysts are paying close attention to this emerging area to seize the investment opportunities it brings.

At present, more and more institutions, including traditional financial institutions such as China Pacific Insurance Group’s China Pacific Investment Management (Hong Kong), have obtained approval from the Hong Kong Securities and Futures Commission to upgrade the existing Category 1 (securities trading) and Category 4 (provision of securities) Opinions) The regulated business license, after upgrade, can provide distribution and investment advisory services to funds with a virtual asset investment ratio of more than 10%. This indicates that traditional companies will intervene in the digital asset field on a large scale in the future. In 2024, we can foresee that Hong Kong's financial system will be further integrated with Web3.0 technology, opening up new possibilities for the development of the global digital economy and blockchain technology.

In the next few days, we will continue to share the six key trends in the "2024 Web3.0 Digital Asset Trend Report". If you want to know more and get the complete report, please follow UWEB official Twitter @UWEB_CN